views

Synthetic Biology Industry Overview

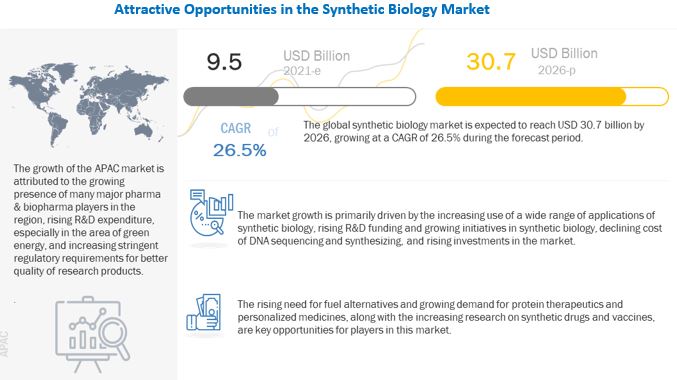

The global synthetic biology market size is expected to reach $30.7 billion by 2026, from $9.5 billion in 2021, at a CAGR of 26.5% during the forecast period. Factors such as widespread application of synthetic biology, increasing R&D financing and initiatives in synthetic biology, decreasing DNA sequencing and synthesis costs, and increasing investment in the market are driving the growth of this market. However, biosafety, biosecurity and ethical issues related to synthetic biology will hamper the growth of this market.

Gather more insights about the market drivers, restrains and growth of the Global Synthetic Biology Market

The oligonucleotides and synthetic DNA segment accounted for the largest share of the tool segment in the synthetic biology market.

On the basis of tool, the synthetic biology market is broadly segmented into oligonucleotides & synthetic DNA, enzymes, cloning technology kits, synthetic cells, chassis organisms, and xeno-nucleic acids. oligonucleotides & synthetic DNA accounted for the largest share of the synthetic biology market for tools.

The medical applications segment accounted for the largest share of the application segment in the synthetic biology market

Based on application, the synthetic biology market is categorized into three segments—medical applications, industrial applications, food & agriculture, and environmental applications. medical applications segment accounted for the largest share of synthetic biology market.

Synthetic Biology Market Regional Outlook

· North America

· Europe

· Asia Pacific

· Latin America

· MEA

COVID-19 impact on the synthetic biology market

Many established pharmaceutical and biopharmaceutical companies, along with players of the market, have stepped forward to contribute to worldwide research efforts by providing synthetic biology for developing test kits, treatments, and vaccines to target the infection caused by the coronavirus. Synthetic biology is highlighted as one of the emerging technologies in a report from the European Parliament. It can fight the COVID-19 pandemic. The National Institute of Health in the US has also identified synthetic biology as one way to speed up vaccine development.

Market Share Insights

· In January 2021, Novozymes launched Frontia GlutenEx. It would help wheat processors increase their gluten protein recovery and, at the same time, cut down on energy consumption.

· In February 2021, Merck partnered with BioNTech (Germany) to supply lipids for the production of Pfizer-BioNTech COVID-19 Vaccine (BNT162b2).

Key Companies Profile

The industry is marked by the presence of various large- and small-scale businesses operators. The market is highly competitive and dominated by key participants that focus on executing innovative strategies like mergers and acquisitions, market penetration, partnerships, and distribution agreements to increase their revenue.

Some prominent players in the global Synthetic Biology market include,

Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Agilent Technologies, Inc (US), Novozymes A/S (Denmark), Ginkgo Bioworks (US), Amyris (US), Precigen, Inc. (US), GenScript (China), Twist Bioscience (US), Synthetic Genomics (US), Codexis (US), Synthego (US), Creative Enzymes (US), and Eurofins Scientific (Luxembourg)

Order a free sample PDF of the Synthetic Biology Market Intelligence Study, published by MarketsandMarkets